Portfolios Built With Purpose

Our turnkey asset management program handles your investing

with precision,

freeing you to focus your advisory voice where it matters most.

Portfolios Built With Purpose

Our turnkey asset management program handles your investing

with precision,

freeing you to focus your advisory voice where it matters most.

Why Advisers Choose CPM

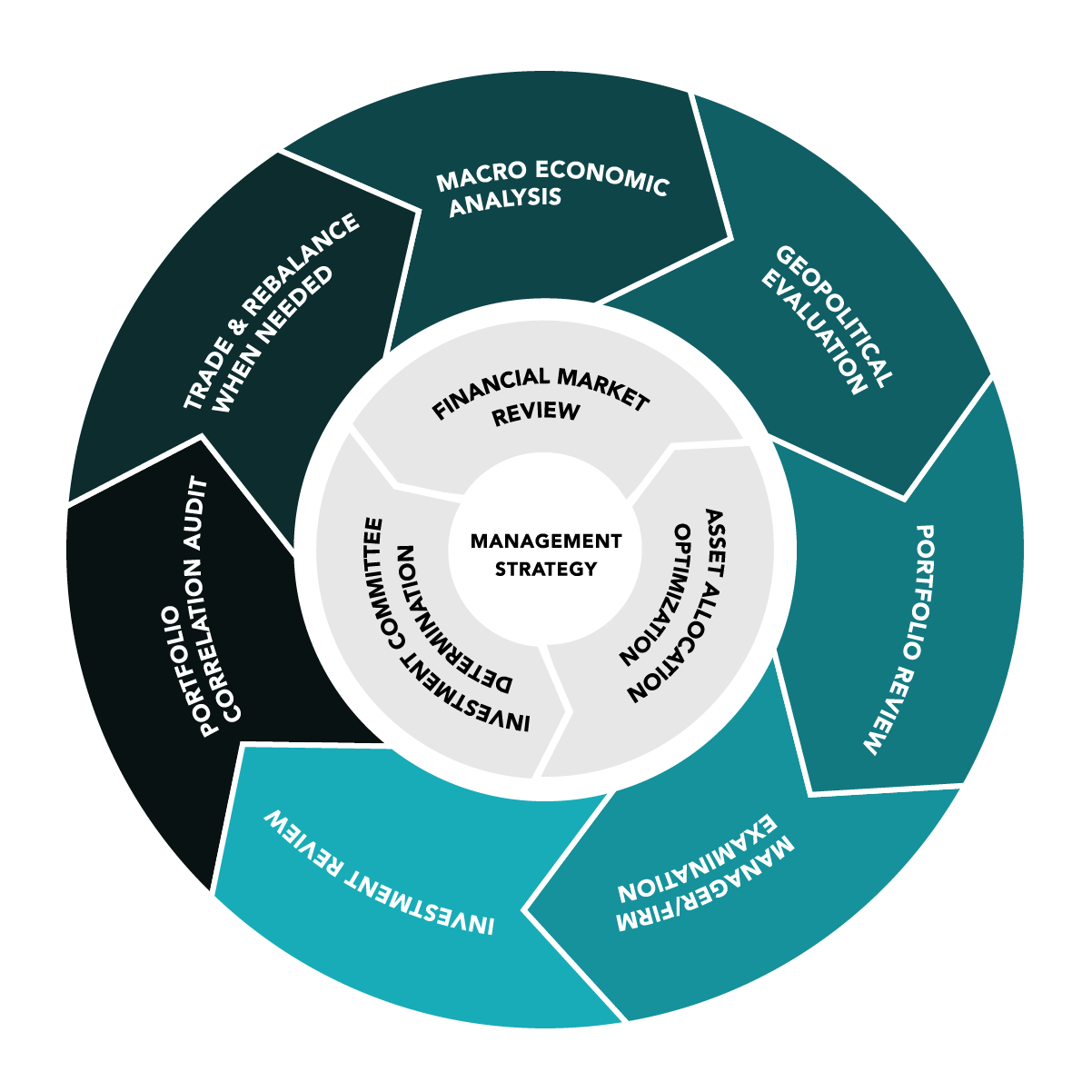

Professional Asset Management

Access research-driven portfolios, fund screening, and active oversight with Traditional and Biblically Responsible Investing (BRI) models on one platform.

More Time for What Matters

With daily investment tasks off your plate, you gain hours to focus on planning, prospecting, and strengthening client relationships.

Build a Practice with Purpose

Build for the long term with our turnkey process and scalable support. Strengthen your practice while keeping client needs front and center.

Why Advisers Choose CPM

Professional Asset Management

Access research-driven portfolios, fund screening, and active oversight with Traditional and Biblically Responsible Investing (BRI) models on one platform.

More Time for What Matters

With daily investment tasks off your plate, you gain hours to focus on planning, prospecting, and strengthening client relationships.

Build a Practice with Purpose

Build for the long term with our turnkey process and scalable support. Strengthen your practice while keeping client needs front and center.

“At Creative Portfolio Management, we believe in forging partnerships built on trust, innovation, and transparency. So our clients can invest with confidence.”

Brent Owens, President of CFD Companies

Getting Started Is Easier Than You Think

Coast-to-coast support, a clear process, and a team ready to help you succeed.

How It Works

Learn

Explore our models and investment philosophy

Launch

Select strategies and onboard your clients with ease

Leverage

Let our team manage portfolios, you focus on growth

Ready to Take the Next Step?

Tell us a bit about your business. We’ll answer questions and help you explore next steps.

Are We a Good Fit?

Hi, I’m Jamie Barber, Director of Strategic Partnerships at Creative Portfolio Management. I can’t wait to learn more about you and your business, and see how we can help.